Our Approach

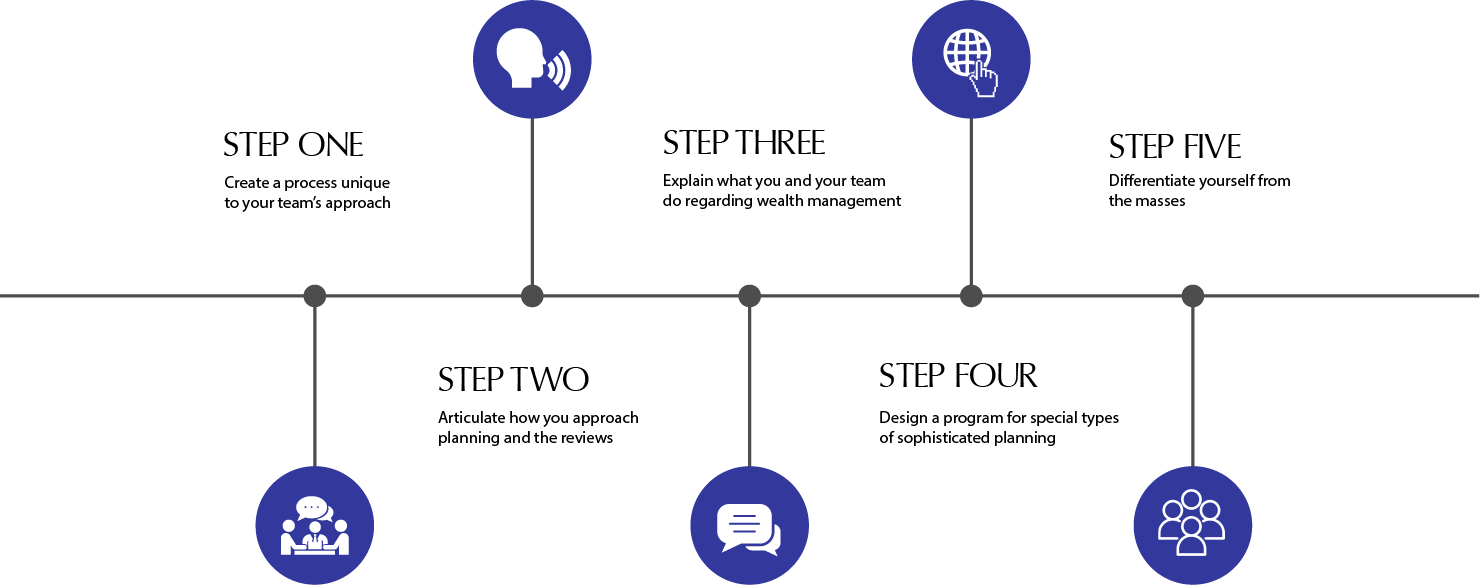

Wealth management goals vary, from income production to long-term growth to short-term liquidity. No two investors are alike, so your particular wealth management objectives, requirements and decisions will be different than anybody else’s. That’s why our team adheres to a disciplined process when designing and monitoring portfolios tailored to your needs.

The process begins with a thorough discovery phase. Here at the onset, we will learn more about your goals and objectives, and also come to understand your risk tolerance, time horizon and other key factors.

Once we know more about you and your goals and reviews your current allocation – all within the context of the current capital market environment – a targeted, personalized asset allocation is developed for you that takes into account all of your investments in order to match your overall objectives. Asset allocation does not guarantee a profit nor protect against loss.

Next, components of the asset allocation are assigned to the various accounts you own, taking into consideration tax status, specific account objectives, asset titling strategies and other factors.

Now that thorough research has been conducted on your behalf, our team can finally recommend appropriate investments – out of thousands that are available to us – that best meet your objectives and tolerance for risk.